Scammers impersonate investment apps amid rising fraud

09 Dec 2024, 03:13 PMScammers are on the rise, targeting trusted names like Paytm Money, Zerodha, Groww, and Aditya Birla with fake apps designed to deceive investors.

Team Head&Tale

By Babu Lal Poonia and Rohit Mishra

Earlier this year, a flurry of fake investment apps mimicking Zerodha flooded the market. Just as the dust began to settle, a new wave of fraudulent apps impersonating Groww, Kotak Securities, Aditya Birla, YES Securities, SMC and many other stock brokers emerged, targeting unsuspecting investors.

These scams highlighted a troubling pattern: scammers are becoming more sophisticated in their attempts to exploit the trust that well-known financial brands command.

Despite efforts to shut them down—through complaints, takedowns, and awareness campaigns—scammers remain relentless. They adapt quickly, devising new tactics to keep their schemes running.

And now, their latest target is Paytm Money, one of India’s leading investment platforms.

How the Scam Unfolds

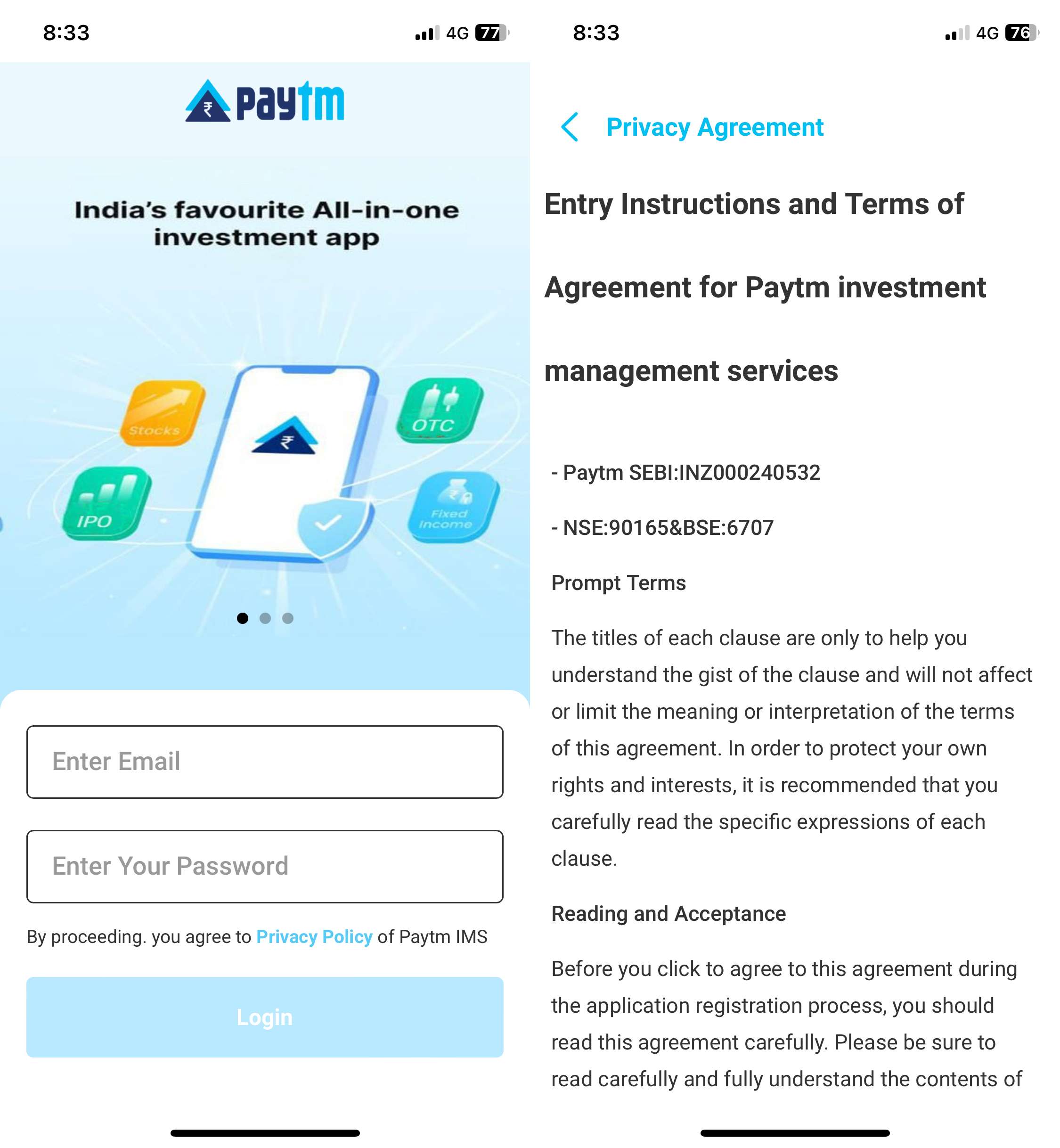

These scammers meticulously orchestrate their fraud. Let’s highlight a recent example of how scammers are pulling an online investment scam using Paytm Money’s brand.

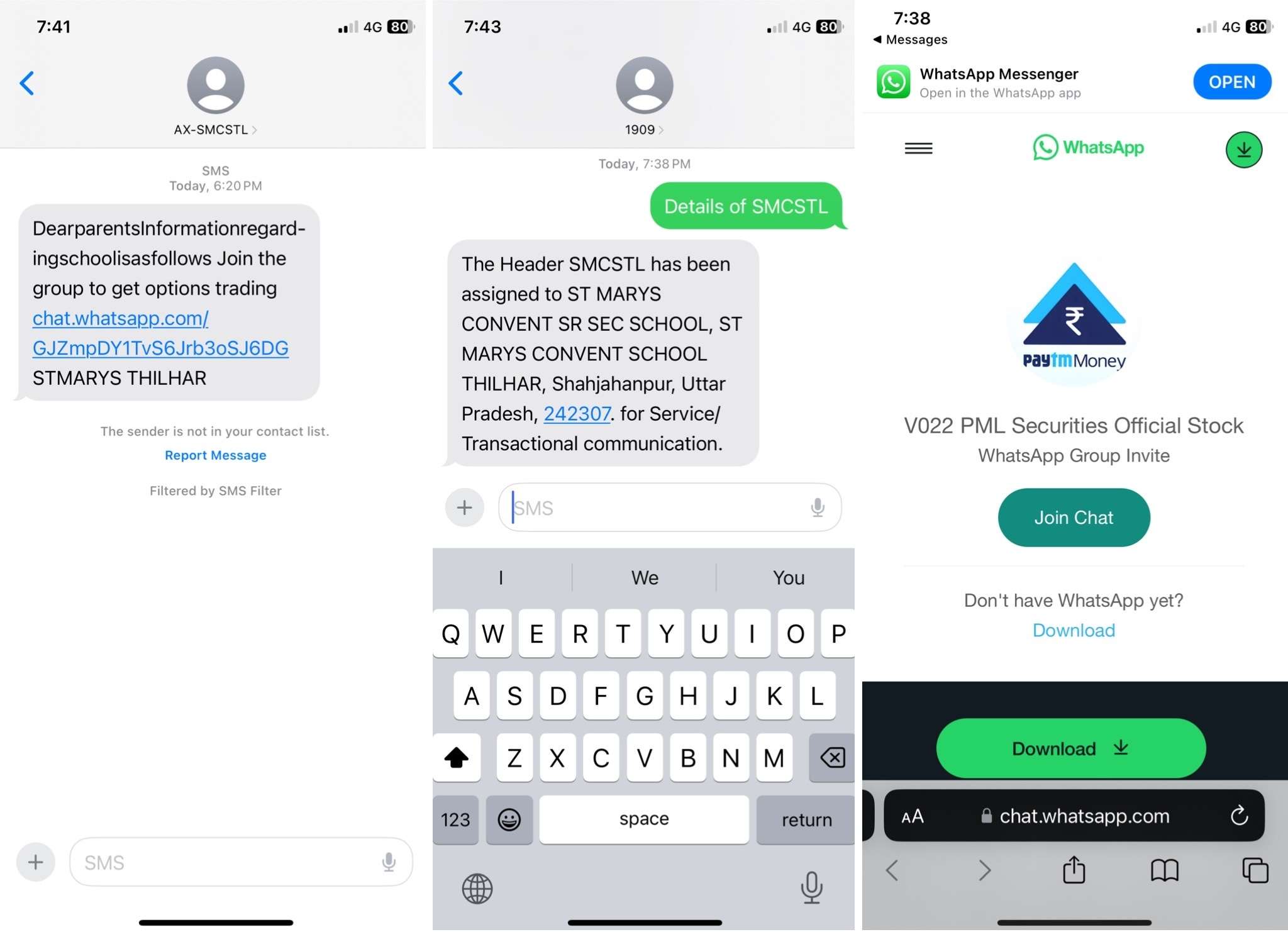

Step 1: On November 3, many individuals received a suspicious SMS with a WhatsApp group link masquerading as an official Paytm Money group. The message, sent from the handle “SMCSTL,” invited recipients to join a WhatsApp group purportedly run by Paytm Money. The scammers knew exactly what they were doing.

Note: The scammers run multiple such groups

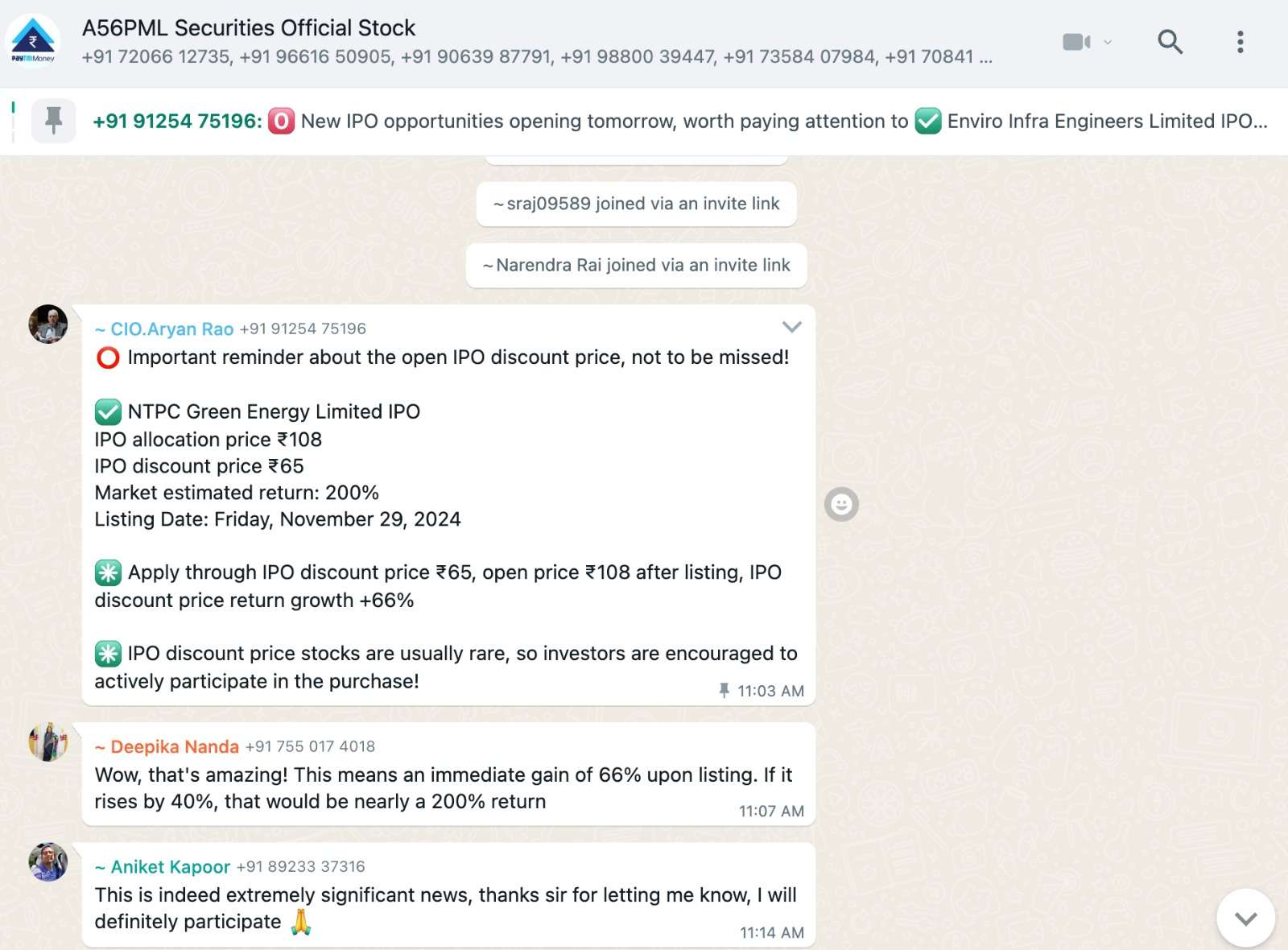

Step 2: In no time, once users joined the group, they were met with a flood of messages and fake testimonials showcasing “abnormal profits.” Screenshots from the group reveal how scammers created an illusion of authenticity, making their scheme appear legitimate.

Step 3: The real manipulation began in private chats. Scammers, posing as Paytm Money representatives, reached out to participants from the WhatsApp group in 1-1 chats, offering them exclusive investment deals – some so-called “deal of a lifetime.” . Their pitch was polished, their tone professional, and their promises irresistible.

Check out this Screen Recording to know how this scam works.

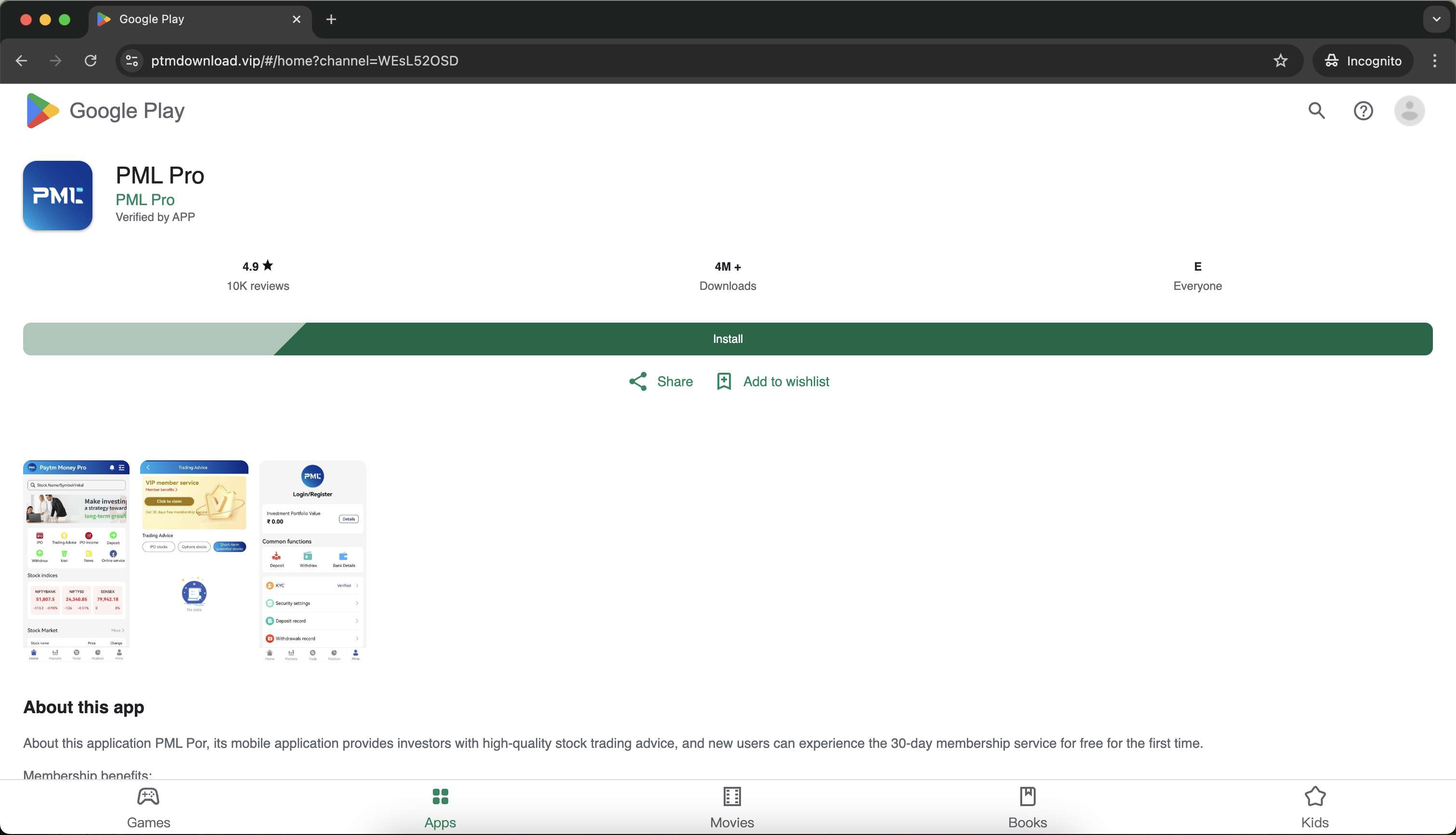

Step 4: The final step? These customer representatives insist victims download these fake impersonated apps. Even when these apps were removed from app stores, scammers had fallback mechanisms in place. They redirected victims to counterfeit websites designed to look like official app stores, ensuring their operation remained uninterrupted.

For example: If a Google Play app is removed, then users are redirected to a link that mimics Google Play’s so that a potential victim thinks of it as a legit app.

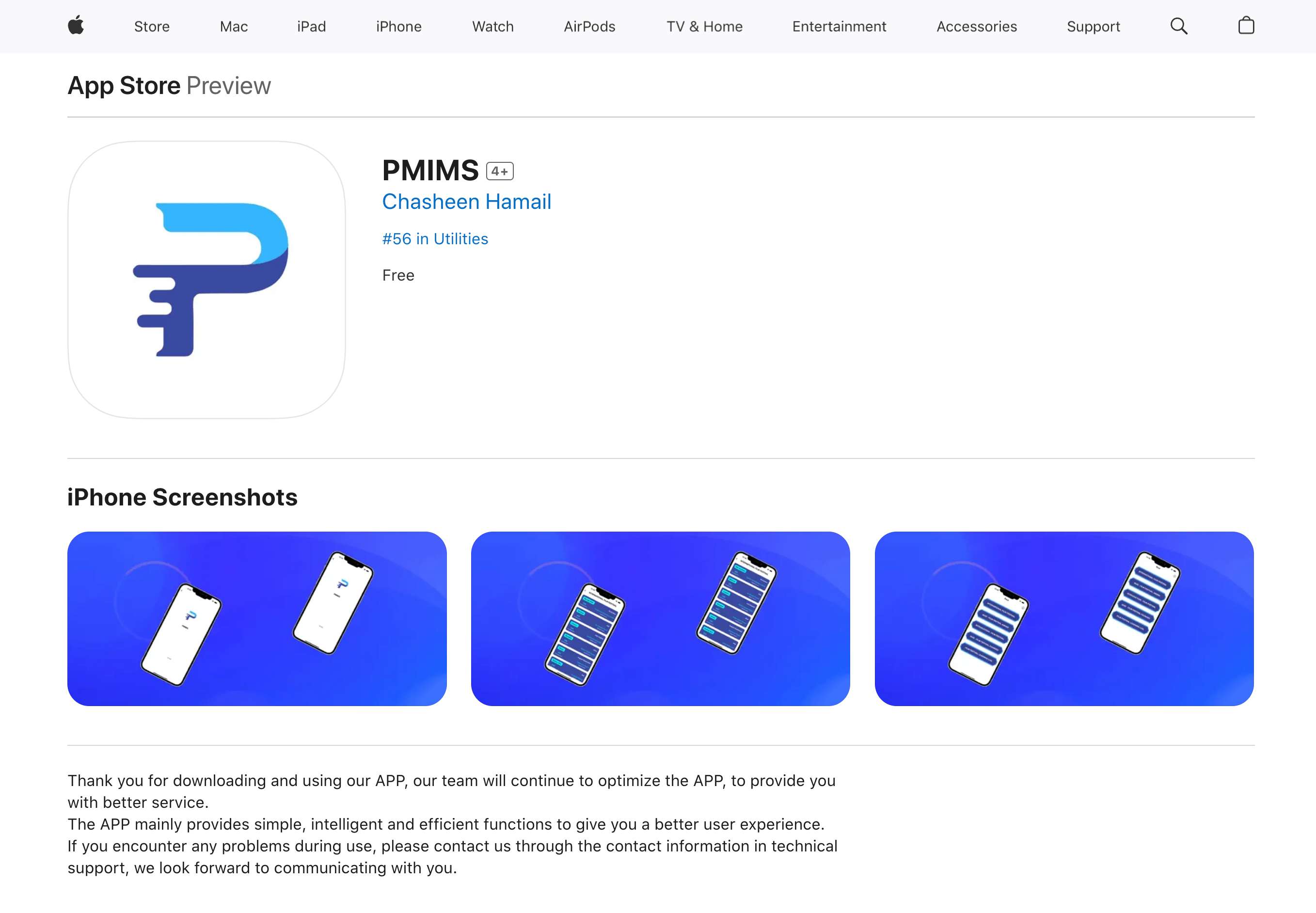

At least seven fake investment apps impersonating Paytm Money have been identified. Three on the Apple App Store (PMIMS, PMLPRO, PML Pro) and two on Google Play (PML Pro, PM-S PMIMS) have been taken down. Two on the Apple App Store (PMIMS, PMLMAX) are still live for 3 weeks now.

The Bigger Picture

Long story short—they pulled off a clever scam by using Paytm Money's logo, brand colors, and overall look to appear legit. But it was all a front—they stole the money and vanished, all while pretending to be Paytm Money.

This isn’t just a Paytm Money problem—it’s an industry-wide menace.

According to data from the Karnataka Cyber Cell, in the first seven months of 2024 alone, online investment frauds in the state totaled Rs 900 crore across 3,094 cases. This points to an average loss of Rs 30 lakh per victim. Nationwide, the estimated fraud could exceed Rs 20,000 crore annually—a staggering figure that underscores the scale of the problem.

What’s even more concerning is that the number of reported cases is only a fraction of the actual frauds being perpetrated, highlighting the significant underreporting in this space.

Who’s Responsible?

While users are often blamed for falling for such scams, the responsibility doesn’t end with them. The larger question is: are these companies doing enough to prevent these frauds? The short answer here is NO.

SEBI-registered companies like Paytm Money, Zerodha, and Groww must take accountability for safeguarding their brands and users. These platforms handle billions of rupees and are trusted by millions. When scammers impersonate them, it’s not just a failure of user awareness—it’s a failure of safeguards.

What steps have they taken to prevent impersonation in the first place? And once they became aware of it, what actions did they take to address it? These are questions that need clear and transparent answers. Companies can’t just shift the blame or, worse, ignore it.

They have a responsibility to safeguard their users and their brand.

While apps like Zerodha and Groww are stepping up, taking proactive measures, and working tirelessly behind the scenes to address these issues, this fight cannot rely solely on individual efforts. Fraud prevention and user protection must be driven from the top down, with regulators, tech platforms, and investment companies coming together to create a safer ecosystem. Trust, once lost, is hard to rebuild—so it’s time for everyone involved to step up and make this a priority.

Regulators like SEBI also need to tighten the screws. Stricter app approval processes, better branding protections, and harsher penalties for negligence are essential to curbing this menace.

This isn’t just about fraud; it’s about trust. And when that trust is broken, it’s not just individuals who lose—it’s the entire system.

----------------------

About Authors

Rohit Mishra, an alumnus of SRCC, Delhi University, brings six years of experience in diverse product roles across fintech startups.

Babu Lal Poonia, a 2013 graduate of NIT Rourkela, transitioned from being an iOS developer to product management.

The duo, formerly colleagues at INDmoney, have spent the past 17 months dedicated to identifying and dismantling fake apps. Together, they have successfully taken down over 7,200 fraudulent applications, making a significant impact in combating online scams.