The Bull Run Broker: Inside Groww's $7 billion IPO

05 Nov 2025, 05:12 AMOver the past three years, millions of young investors bought their first stock on Groww. Now, it's listing itself to the very users who made it India’s largest broker.

Arti Singh

“If the weekly F&O (futures and options) expiry goes away, everything evaporates. Groww’s 60-70% revenue comes from F&O – and that’s a crazy number. The regulatory risk here is huge. All Groww founders should do is keep praying Sebi doesn’t move until after the IPO,” a fintech founder told me a couple of days ago.

He may have said it half in jest, but Groww can breathe easy. Sebi, which in September reportedly began consultations on the possible phase-out of weekly F&O contracts, clarified last Friday that an outright ban is off the table. “While concerns over retail participation in derivatives are valid, an outright ban is not feasible,” SEBI Chairperson Tuhin Kanta Pandey said at an event.

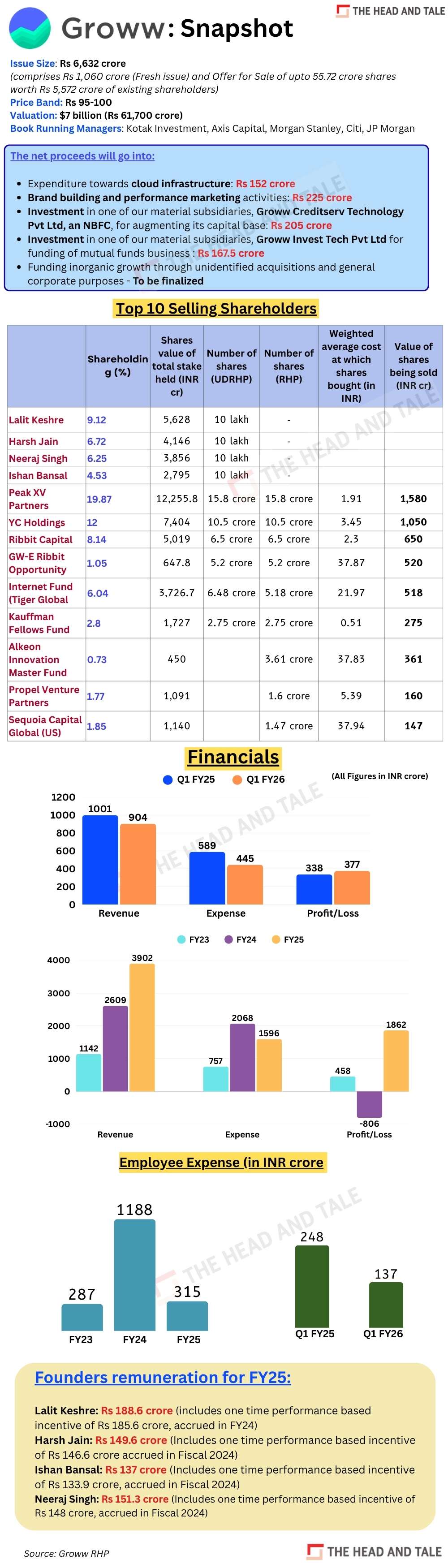

Founded in 2016 by four former Flipkart colleagues – Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, Groww has emerged as India’s largest stockbroker by active users. This week, it heads to the public market with a $7 billion valuation – the biggest fintech listing since Paytm’s turbulent $19 billion debut in 2021.

The timing is symbolic. Another Peak XV-backed company, Pine Labs, is also opening its IPO this week at a $2.7 billion valuation. But this round of listings marks more than a milestone for Indian fintech. It’s also a personal victory for Peak XV’s managing directors, Shailendra Singh and Ashish Agrawal. Between the two, Agrawal’s decade-old bet on Groww appears to be paying off handsomely – especially when compared with the 27-year-old Pine Labs.

When Groww’s IPO opened on November 4, the response was staggering as the anchor book was oversubscribed 15 times, pulling in bids worth Rs 50,000 crore against an allocation of Rs 3,000 crore.

Even Zerodha’s Nithin Kamath, joined in the congratulations, writing on social media, “About 20% of all Groww IPO applications are from Zerodha customers.”

Groww began as a mutual fund platform before entering stockbroking in 2020 – right in the middle of the pandemic bull run, when retail investors flooded the markets.

At the time, Zerodha was already rewriting India’s brokerage story. In 2019, the Kamath brothers – Nithin and Nikhil – had dethroned ICICI Securities to become the country’s largest broker by active clients. The investor frenzy that followed made Zerodha a household name and the Kamaths, billionaire icons of India’s retail investing boom.

But in just three years, Groww overtook Zerodha – and has held the top position since.

What worked for Groww? A beautifully designed app targeting the young generation? May be.

“Groww and Zerodha have similar business models,” said a senior executive, who operates in asset management space. “Except Groww is far more aggressive on customer acquisition, while Zerodha focuses on traders. The Groww founders are pure tech guys. If you ask them for a broking platform, they’ll build the best one; if you say mutual funds, they’ll redesign it for that too. And crucially, they’ve built a profitable business on top of it.”

Another wealth-tech founder said Groww’s execution made the difference. “When they launched broking, they started fresh. Their pitch was simple: direct mutual funds and broking in one clean app. All Zerodha had to do was launch a unified platform…and they still haven’t. Zerodha has a different tech philosophy, but a 25-year-old investor doesn’t want to juggle three apps.”

The early 2020s brought a generational shift in investing – and Groww caught that wave perfectly.

“When Paytm launched its brokerage arm, it felt like a Jio-BlackRock moment then,” one founder recalled. “Everyone was scared. But success isn’t just about being first, it’s about focus. In hindsight, these products look simple, but they’re not. Groww doubled down on broking and did nothing else for two years.”

That clarity of focus paid off. When Groww entered stockbroking, India had roughly 50 lakh active investors. Today, that number exceeds 4.5 crore. And, Groww alone accounts for over 1.2 crore active NSE clients.

Now the question is no longer whether Groww can grow. It’s whether its business model can withstand a market that finally stops rallying?

What numbers tell

Over 84% of Groww’s FY25 revenue came from broking services – translating to about Rs 3,297 crore. Of that, derivatives, particularly F&O trading, accounted for roughly 62% in the June quarter, as per an industry report.

The remaining Rs 605 crore came from other lines like mutual funds, loans, and asset management during the period.

In the April–June 2025 quarter (Q1 FY26), revenues from broking services accounted for 79.49% of total revenues – at Rs 719 crore. But this marked a decline from Rs 875 crore in the same period the previous year.

In the quarter ended June 2025, as the Nifty fell nearly 4,000 points, Groww’s own numbers began to twitch. Broking transacting users dropped from 72 lakh a year earlier to 61 lakh.

New transacting users (NTUs) fell by half, from 16 lakh to 7.6 lakh.

The company blamed “regulatory changes and slowdown in the market.” Both were true – and both were beyond its control. In last 7-8 months, NSE active client base has declined.

According to the Redseer Report quoted in the Groww RHP, there was also a decline in the Indian capital market, with the Nifty 50 falling from ~26,200 points from the end of September 2024 to ~22,100 points by early March 2025. This resulted in the net new additions in demat accounts for the industry in the three months ended June 30, 2025 declined to 67 lakh from 1 crore in the three months ended June 30, 2024. This also affected the company’s numbers too.

Retail investors had peaked the previous year – and their participation has since waned. The business model remains fundamentally tied to market volumes and retail participation –both of which are cyclical and, lately, declining.

Groww’s answer is diversification. The NBFC arm Groww Creditserv Technology contributed Rs 52.7 crore to the company’s consolidated revenue from operations in June 2025 quarter, against Rs 35 crore reported during the same period previous year. The FY25 revenues from the unit jumped from a mere Rs 25 crore in FY24 to Rs 196 crore.

In FY25, the lending arm turned profitable. It reported Rs 6.7 crore in profits over Rs 24 crore in losses in FY24. As of June 2025, Groww Creditserv manages a Rs 1,164-crore loan book.

The company is also pushing into loans against securities, mutual fund distribution, and wealth management through “W by Groww”. It’s a logical next step. If retail trading is cyclical, advisory income can be steadier. But it also changes the game.

Last month, Groww completed its acquisition of Fisdom – a Rs 961-crore deal that signals its intent to go deeper into managed wealth. Fisdom’s institutional and HNI clients add depth to Groww’s otherwise mass-market footprint.

But diversification takes time, and time is what the markets rarely offer. For now, broking remains the core business.

The real test for Groww may come not from regulators, but from peers.

Other stock brokers, including Zerodha have already cautioned about a sharp revenue drop. If those platforms, with deeper trading bases, are feeling the heat, what happens to Groww’s model – one driven by customer acquisition and retail optimism? The platform's entire thesis rests on continuously bringing new investors into the market and gradually converting them into regular transacting users. But if the market cools and new investors stay away, the engine that powered Groww’s rise could sputter.

[You wouldn’t want to miss our in-house report on India’s brokerage industry — it maps the stockbroking platforms and offers a comprehensive view of the competitive landscape. TrendScape: State of India’s stock broking industry.]

The India story

Only about 7% of Indians invest in equities – a fraction of the 40-50% in US. Every year, millions of new demat accounts open. Every dip feels temporary. But the story has limits. Retail participation has begun to plateau.

That slowdown isn’t just macro fatigue -- it’s behavioural. Retail flows in India mirror the market’s mood almost perfectly. The participation surge in euphoria and vanish in fear. As the wealth-tech founder puts it, “A new investor only comes when the market rallies.”

So what should investors make of the Groww IPO?

The bullish case is obvious: a brand synonymous with retail investing, 1.2 crore users, profitable growth, a massive addressable market. Few Indian fintechs can claim that trifecta. But the bear case is equally compelling. Dependence on a volatile revenue stream, rising costs, regulatory overhang, and a valuation that already prices in tomorrow’s promise.

The wealth-tech founder said, “I see almost zero chance that this IPO will fail. These are brands that young people use. Fundamentals don’t matter right now. It’s India’s first dotcom bubble – everyone’s buying the story.”

Groww’s IPO was always going to attract attention. It sits at the intersection of India’s two great obsessions – the stock market and the smartphone. Over the past three years, millions of investors in their twenties and thirties have bought their first stock on Groww. Now, that same generation forms the natural audience for its IPO. In many ways, Groww is selling its listing to the very users who made it India’s largest broker.

The wealth-tech founder described this new investor psychology bluntly, “It’s very hard to argue on fundamentals when the market’s rising. No one cares. We saw this with Zomato, Swiggy, Ola – young investors want to buy the brands they use. Fundamentals come later in life. And, also everyone forgets the failed IPOs.”

“It’s not unique to India. The same phenomenon has played out in the US with Robinhood. Investors today are buying narratives – macro stories about disruption and generational change. It’s a regime shift,” the founder said. “A new set of companies taking over, old ones fading away. And in Groww’s case, that’s actually true. They’re already the largest brokers.”

The irony, of course, is that this very optimism can turn fragile overnight. When the next correction comes – as it always does – it will test not just Groww’s model, but India’s retail conviction itself.

“Once the crash comes, people will lose a lot of money. The bull run will be over,” the founder added.

For now, the momentum holds. Groww’s marketing machine continues to promote every IPO – including its own. And that, too, is part of the brilliance. “If you’re a broker with 1.2 crore users and you can’t sell your own IPO, what’s the point?” the founder laughed. “They’ve been smart. They advertise every IPO – so when their turn comes, it doesn’t look self-serving.”

The author is Founder and Editor of The Head and Tale. She can be reached at

[email protected]

Tweets @artijourno