India's Money Makeover: From 1949 to demonetisation and to the UPI boom

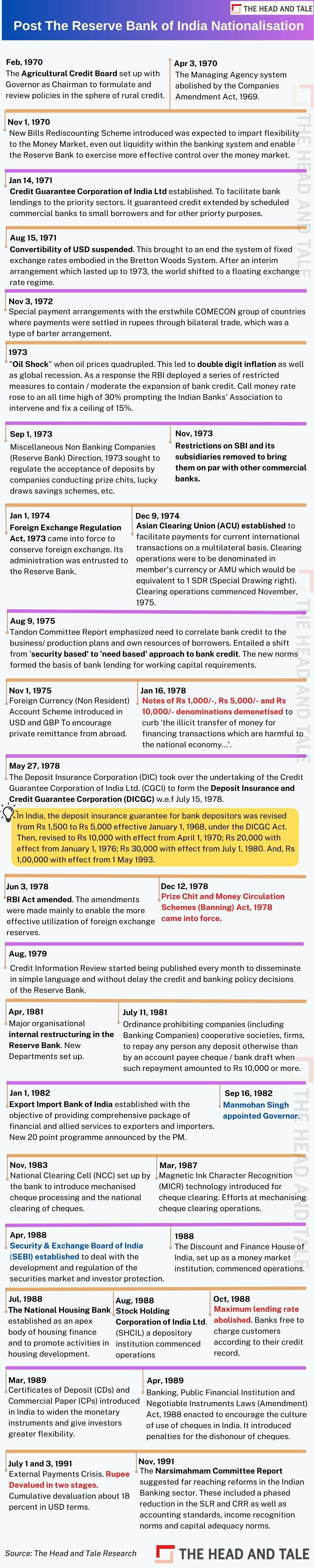

14 Nov 2025, 02:02 PMIn this edition, we look at the Reserve Bank of India post its nationalisation, a period that quietly shaped India's financial destiny.

Muskan Singh

In this Money Trivia edition, we look at the Reserve Bank of India post its nationalisation -- a period that quietly shaped India's financial destiny long before terms like fintech and digital payments entered our lives.

From just a concept to being nationalised, the RBI's journey is quite fascination. Do check our previous edition of Money Trivia on this.

When the Reserve Bank of India became fully state-owned on 1 January 1949, it marked more than a simple change of ownership. The move signalled that monetary power would be central to India’s nation-building project. Through the 1950s and 1960s, the RBI’s role expanded from currency management to steering credit flows, regulating banks, and supporting the government’s Five-Year Plans. The Banking Regulation Act, which came into force in 1949, strengthened the central bank’s supervisory grip and laid the foundations of modern banking oversight.

But the real shift in India’s financial landscape came two decades later. In July 1969, the nationalisation of 14 major commercial banks brought nearly 85% of deposits under state control. It was a moment that redefined Indian banking when credit was pushed towards agriculture, small industries, cooperatives, and rural borrowers. A second round of nationalisations in 1980 reinforced this direction and expanded the public-sector banking network deep into the country’s hinterland.

Fast-forward to the 2000s and early 2010s, when the RBI’s priorities were shifting once again towards financial stability, inflation targeting, and a calibrated opening up of India’s payment systems. Yet, nothing would match the shock and scale of what came on 8 November 2016.

In a late-evening announcement that caught the nation off-guard, the government declared the immediate withdrawal of Rs 500 and Rs 1,000 banknotes. The stated goals were to eliminate black money, curb counterfeit currency, and push India toward greater formalisation and digital adoption. Long queues outside banks, frantic deposits, and a rush to exchange notes became defining images of the period. By the end of the exercise, nearly all invalidated currency had returned to the system -- sparking debates that continue even today.

Having said that, the demonetisation gave wings to UPI -- a system that reshaped how India pays, lends, and does business today.

.jpg)

.jpg)