At a Glance: Fintechs rule personal loan volume, but bank-like on gender thinking

03 Jul 2025, 01:32 PMOf the total, only 12% or Rs 1,06,548 crore of the overall value of personal loans accounted for fintech NBFCs in FY25.

Joseph Rai

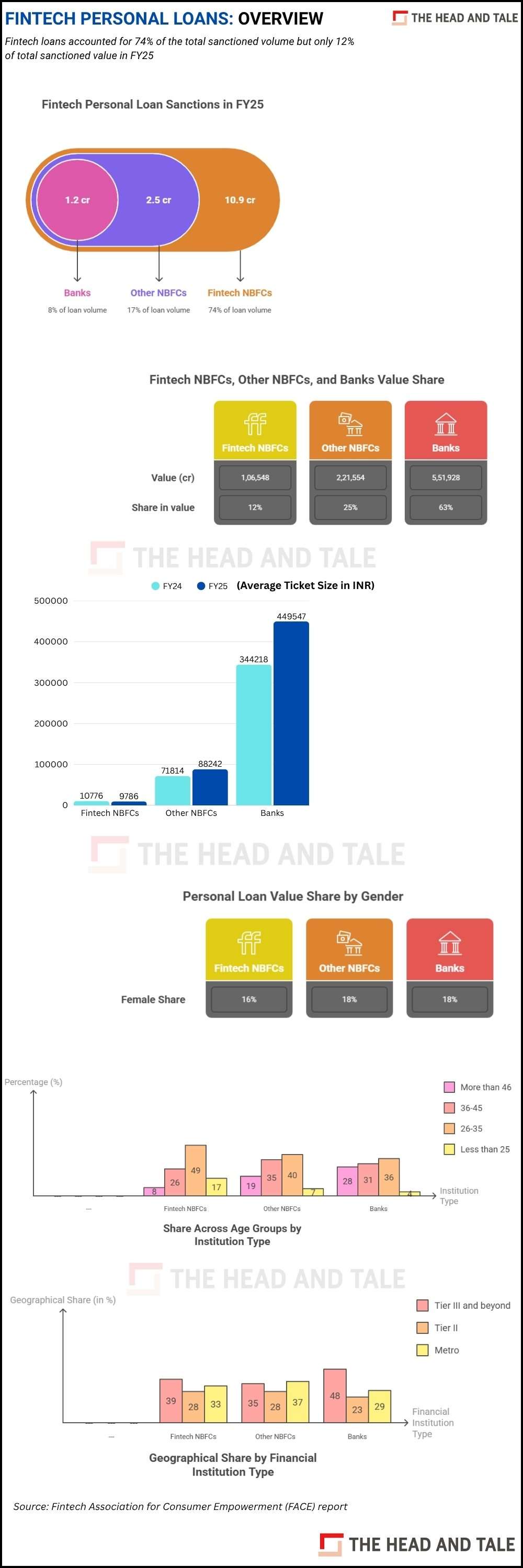

Total personal loans sanctioned by fintech non-banking financial companies (NBFCs), other NBFCs and banks amounted to Rs 8.8 lakh crore in terms of value and 14 crore in terms of volume in the financial year ended March 31, 2025.

Of the total, only 12% or Rs 1,06,548 crore of the overall value of personal loans accounted for fintech NBFCs in FY25, according to a report by Fintech Association for Consumer Empowerment (FACE), a Reserve Bank of India (RBI) recognised self-regulatory organisation in the fintech sector.

This is higher than the Rs 96,033 crore in sanction value recorded by fintech NBFCs in the previous financial year FY24 and a sharp jump from Rs 12,245 crore registered in fiscal FY21.

Remarkably, while the personal share value of fintech NBFCs is still small in the broader market where traditional banks still dominate, in terms of volume fintech NBFCs continued to dominate, accounting for 74% or 10.9 crore personal loans allocated during FY25.

"It is worth noting that customers take personal loans for multiple reasons to tap opportunities and deal with the unexpected. Access to convenient digital credit is an essential component of a financial toolkit for managing finances and building resilience," the report said.

Overall, the average ticket size remained slightly under Rs 10,000 in FY25, falling marginally by 10% from the previous fiscal. The average ticket size has stayed between Rs 9000 and Rs 11,000 since FY21.

The share of personal loan allocation to females continued to stay below 20%. In FY25, the share of the loans disbursed to females was just 16%. This is part of the larger trend as NBFCs and banks also extended a smaller portion of loans to females. However, in terms of the average ticket size of loans to females by fintech NBFCs in FY25 at Rs 11,388 pipped their male counterparts with just Rs 9,533.

In terms of the share of personal loan allocation based on age, over two-thirds of the money went to people who are less than 35 years of age. It is also clear that a large portion of loans were extended to young people in the age group of 26-35 and smaller portion to people over the age of 46.

Interestingly, fintech NBFCs presence in India's furthest corners of the country is also evident as 39% of the total loan value it sanctioned in FY25 was allocated to tier III cities and beyond. This is higher than the share of the other NBFCs but tier III and other remote regions also make up a substantial chunk of the market for traditional banks as well.