Aye Finance July-Sept revenue up 22% to Rs 436 crore, net profit falls

12 Nov 2025, 01:26 PMThe NBFC is currently in the process of going public, having received SEBI's approval for its DRHP in April 2025.

Team Head&Tale

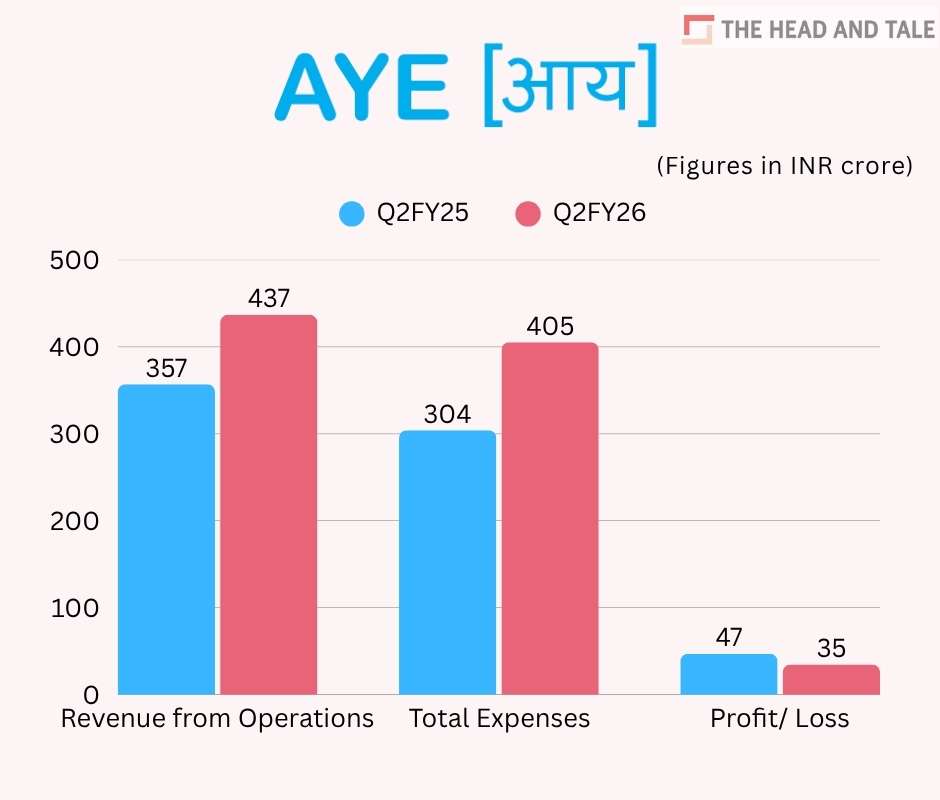

Aye Finance recorded a 22% jump in revenue from operations to Rs 436.6 crore in the July-September quarter of FY26 from Rs 357.4 crore in the same period of the last fiscal.

Aye Finance's net profit decreased to Rs 34.5 crore in the September quarter from Rs 46.9 crore in same quarter of FY25, the Inc42 reported based on the company's financial disclosures.

Total expenses of Aye Finance grew to Rs 405.2 crore during the quarter as compared to Rs 303.8 crore in the July-September quarter of FY25.

Employee cost jumped to Rs 121.2 crore in the quarter ended September from Rs 91.5 crore in the previous financial year's corresponding quarter.

The company, founded by Sanjay Sharma and Vikram Jetley in 2014, is currently in the process of going public, having received SEBI's approval for its DRHP in April 2025. The proposed IPO comprises a fresh issue of equity shares worth up to Rs 885 crore and an offer for sale of up to Rs 565 crore, with investors like LGT Capital, CapitalG, A91 Fund, MAJ Invest, and Alpha Wave offloading their shares via the offer for sale (OFS).

Aye Finance offers affordable business loans to microenterprises using cluster-based credit assessment with AI algorithms to assess risk in the absence of traditional business documents.