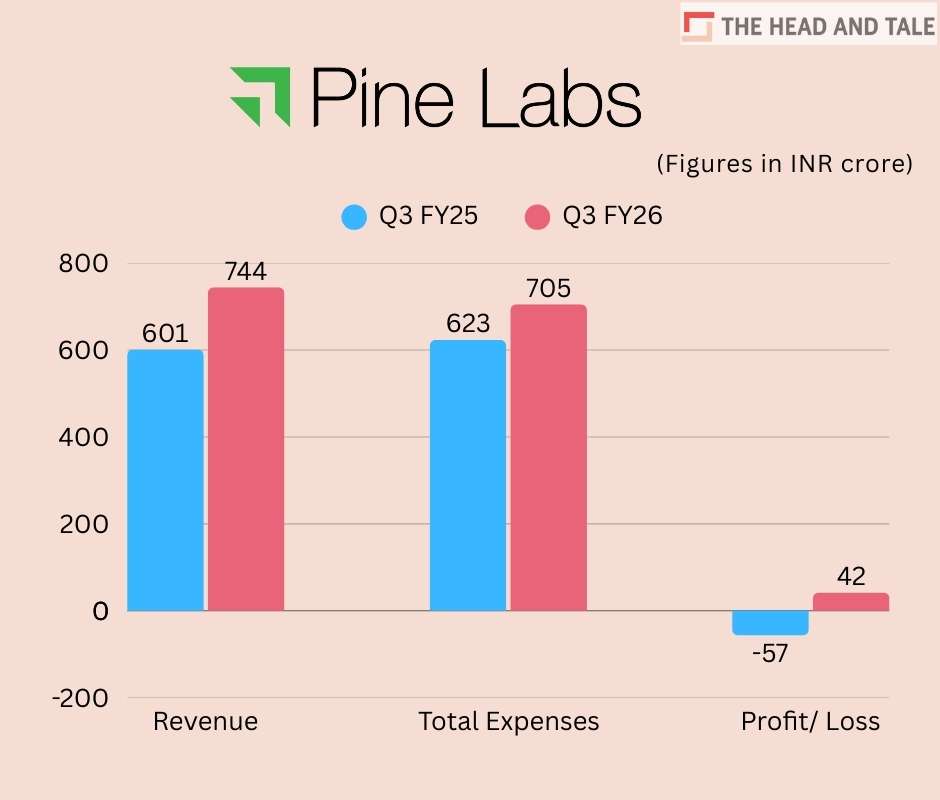

Pine Labs Q3 revenue up 24% to Rs 744 crore

29 Jan 2026, 05:43 PMIt posted a net profit of Rs 42 crore in Q3 FY26 compared to Rs 57 crore in net losses in Q3 FY25.

Team Head&Tale

Payments services major Pine Labs increased revenue by 24% in Q3 FY26 to Rs 744 crore as compared to Rs 601 crore in the same period previous fiscal.

It posted a net profit of Rs 42 crore in Q3 FY26 compared to Rs 57 crore in net losses in Q3 FY25, stock exchange filings show. Its total income stood at Rs 780 crore for the quarter ended December.

Total expenses rose by 13% to Rs 705 crore in Q3 FY26 compared to Rs 623 crore. Employee benefits accounted for the main chunk of expenses at Rs 263 crore.

Pine Labs floated its initial public offering (IPO) late last year and was listed on the bourses at a 9.5% premium over its issue price of Rs 221 per share.

Earlier this month, Pine Labs-owned fintech infrastructure platform Setu got RBI approval to increase its stake in RBI-licensed account aggregator Agya Technologies Pvt Ltd to 100%.