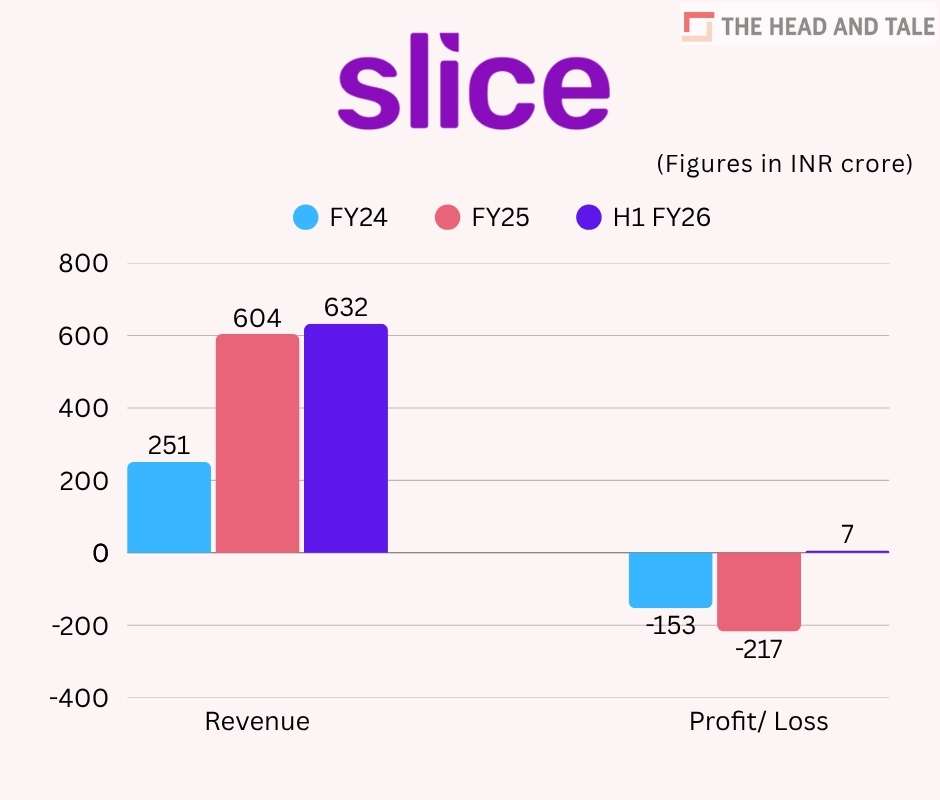

Slice Small Finance Bank FY25 losses widen to Rs 217 crore

12 Nov 2025, 01:14 PMHowever, the Bengaluru-based fintech has booked Rs 6.5 crore in profits in the first half of FY26.

Team Head&Tale

Bengaluru-based Slice Small Finance Bank has turned profitable in the first half of financial year ending March 2026.

However, the fintech's loss jumped to Rs 217 crore in FY25 against a loss of Rs 153 crore reported in FY24 -- "

The small finance bank reported a pre-ESOP profit of Rs 43 crore for H1 of FY26, the rating agency added.

Slice reported total income of Rs 632 crore during the first half of FY26, compared with Rs 604 crore in the full financial year FY25 and Rs 251 crore in FY24, according to data from credit rating agency Crisil.

Ever since the amalgamation of Slice and North East Small Finance Bank took effect in October 2024, the bank’s capitalization has "strengthened considerably." The net worth rose from Rs 61 crore as on March 31, 2024, to Rs 849 crore as on March 31, 2025, and further to Rs 891 crore as on September 30, 2025.

The assets under management (AUM) grew by 254% (including the effect of amalgamation) over fiscal 2025 to Rs 2,954 crore as on March 31, 2025 and further to Rs 3,759 crore as on September 30, 2025.

On September 30, 2025, the book comprised digital, unsecured personal loans (~76%), secured portfolio comprising MSME loans (~14%) and acquired direct assignment (DA), business correspondent book and other term loans extended (~9%).

The digital loan portfolio, which accounts for approximately 77% of the overall portfolio as on September 30, 2025. Around 87% of this book corresponded to loans with ticket sizes of Rs 75,000 or below.

As on September 30, 2025, the bank reported gross non-performing assets (GNPA) and net non-performing assets (NNPA) of 5.8% and 4.2%, respectively – lower than 6.3% and 4.7% as on March 31, 2025.

"Majority of the outstanding stock of NPA is from the legacy portfolio which will run down over time, and the performance of newer portfolio remains a key monitorable," the agency stated.

The small finance bank’s deposit base has grown by 60% to Rs 2,418 crore on March 31, 2025. For H1, FY26, the deposits have grown by another 61% to Rs 3,896 crore, of which the share of current and savings accounts (CASA) was 27.5%.

On the assets side, bank has recently launched its credit card business which has been erstwhile Slice’s core competence in the past and is expected to be the bank’s focus area in the medium to long run.

Slice founder Rajan Bajaj is the largest shareholder in Slice Small Finance Bank (the merged entity between NESFB and Slice), and the other major shareholders include Gunosy Capital, Blume Ventures, Tiger Global and Insight Partners.