UPI in Nov: Broker value falls 25% as spending softens across merchant categories

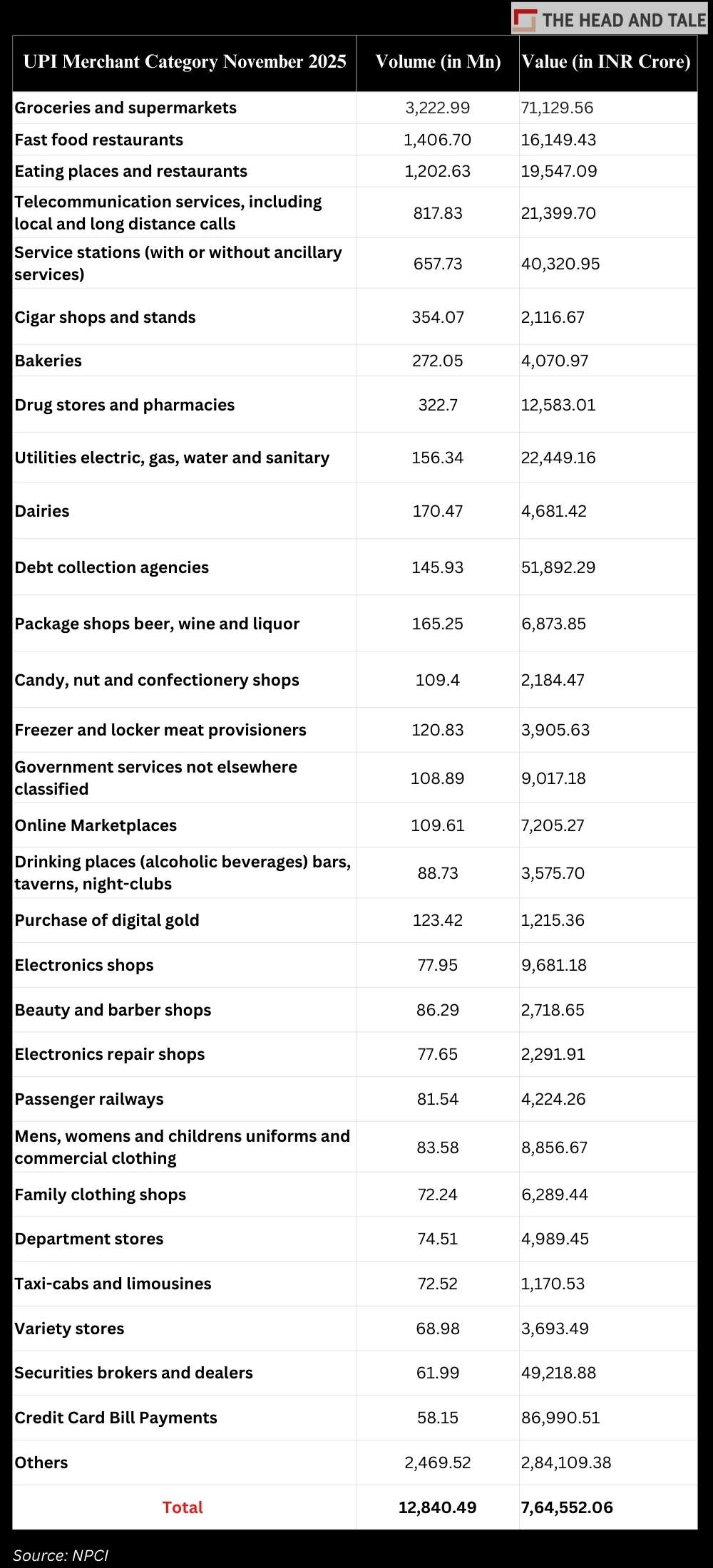

09 Dec 2025, 02:13 PMCredit card bill payments via UPI during the month was at Rs 86,990.51 crore across 58.15 million transactions.

Team Head&Tale

The value of securities brokers and dealer transactions via the unified payments interface (UPI) declined over 25% to Rs 49,218.88 crore in November as compared to Rs 66,095.52 in the previous month.

The overall value of the merchant category-wise purchases via UPI fell to Rs 7.64 lakh crore in November across 12,840.49 million transactions as compared to Rs 8.25 lakh crore in October across 13,027.56 million transactions, according to data released by National Payments Corporation of India (NPCI).

Groceries and supermarkets, which accounts for the largest share, recorded over 3,222.99 million transactions worth Rs 71,129.56 crore in November versus 3,273.2 million transactions worth Rs 76,073.21 crore in the previous month.

The value of debt collections via the UPI rose to Rs 51,892.29 crore in November from Rs 50,614.85 crore in October. In September the value of debt collections had dropped to its lowest to Rs 48,457.21 crore since June 2023.

Digital gold purchase via the UPI fell to Rs 1,215.36 crore in November as compared to Rs 2,290.36 crore in the previous month. The value of digital gold purchase via UPI had jumped 60% in October helped by the festive season.

Credit card bill payments via UPI during the month was at Rs 86,990.51 crore across 58.15 million transactions.

Men's, womens and childrens uniforms and commercial clothing saw 83.58 million transactions worth Rs 8,856.67 crore versus 89.1 million worth Rs 10,082.93 crore in October; and family clothing shops category witnessed transactions 72.24 million worth Rs 6,289.44 crore against 72.7 million worth Rs 6,713.91 crore in October.

Volume and value both dropped for online marketplaces during the month. Online marketplaces witnessed 109.61 million transactions worth Rs 7,205.27 crore via UPI payments during the month as compared to 126.2 million transactions worth Rs 8,350 crore.

Fast food restaurants recorded 1,406.70 million transactions worth Rs 16,149.43 crore in November; and eating places and restaurants saw 1,202.63 million UPI transactions worth Rs 19,547.09 crore.

Service stations registered 657.73 million transactions worth Rs 40,320.95 crore across during the month; utilities recorded 156.34 million transactions worth Rs 22,449.16 crore; and telecommunications logged 817.83 million transactions worth Rs 21,399.70 crore.

Electronic shops saw 77.95 million transactions worth Rs 9,681.18 crore in November. Government services category recorded 108.89 million UPI transactions worth Rs 9,017.18 crore.

Drug stores and pharmacies recorded 322.70 million transactions worth Rs 12,583.01 crore in November.

Overall UPI volumes for the month of November was at 20.46 billion transactions worth Rs 26.31 lakh crore, with peer-to-peer (P2P) payments accounting for 7,626.49 million transactions valued at Rs 18.67 lakh crore.