Payments company MobiKwik has reported its quarterly results for the third quarter of fiscal year 2024-2025 (Q2 FY25).

For the quarter ended December 31, 2024, the Gurugram-based fintech has posted Rs 269 crore in revenue from operations -- a decline from previous quarter (Q2FY25) which stood at Rs 290 crore. However, on a yoy basis, the revenue has slightly increased from Rs 228.9 crore.

MobiKwik's revenue from payments jumped on yoy basis to Rs 196.5 crore in Q3FY25 from Rs 73.9 crore in Q3FY24. The payments revenue during Q2 FY25 stood at Rs 187.7 crore.

However, the financial services revenue seems impacted as it fell on yoy basis to Rs 73 crore from Rs 155 crore reported in Q3FY24. In Q2 FY25, the revenue from this segment stood at Rs 102.9 crore.

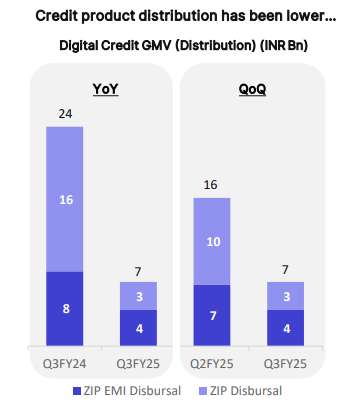

According to the company's financial results, credit product disbursement has been slower during the quarter. "ZIP has been scaled down due to lower appetite from lending partners for small ticket credit product."

On the expense side, payment gateway cost stood at Rs 143.7 crore in Q3 FY25, compared to Rs 135.6 crore reported in Q2, and Rs 50.8 crore reported during the same quarter in FY24. Lending operational expenses stood at Rs 24.7 crore -- a surge on Q-o-Q basis i.e. Rs 17.5 crore and sharp decline from Rs 79 crore that was reported in Q3FY24.

Financial guarantee expenses, on the other hand, has increased on quarterly basis to Rs 17 crore from Rs 6 crore.

Employee benefits costs stood at Rs 44 crore compared to Rs 43.5 crore in Q3, and Rs 28 crore in the previous year.

The company's losses widened during the third quarter. MobiKwik posted a net loss of Rs 55 crore, compared to Rs 3.6 crore during Q2 FY25; and a profit of Rs 5 crore posted a year earlier.

MobiKwik, in its filings, stated that the Company had entered into an agreement (referred to as "waiver agreement") with one of its lending partners, whereby the company had agreed to forego income receivable related to financial services amounting to Rs 24 crore pertaining to quarter ended 30 June 2024 which had been netted off against revenue from financial services during the quarter ended 30 September 2024. Pursuant to the waiver agreement, the lending partner had also agreed to irrevocably waive it's right to receive facilitation fees from the company amounting to Rs 42 crore (out of which Rs 38.5 crore pertains to quarter ended 30 June 2024 and Rs 3.6 crore pertains to the year ended 31 March 2024) which had been netted off against lending operational expenses during the quarter ended 30 September 2024.

The Head and Tale then

exclusively reported that the agreement MobiKwik referred to in its statement was with none other than its P2P (peer-to-peer) lending partner -- Lendbox.

In its Q3 results, the company further noted, "Subsequent to the period ended 31 December 2024, MobiKwik said it has also agreed with one of its lending partners for the waiver of lending expenses payable. This has resulted in reversal of lending operational expense amounting to Rs 23.5 crore during the current quarter (out of which Rs 9 crore pertains to quarter ended 30 September 2024, Rs 12 crore pertains to quarter ended 30 June 2024 and Rs 2 crore pertains to the year ended 31 March 2024)."

As of December 31 2024, the company had 172 million registered users. Of this, 4.5 million were merchant users. Its payment gross merchandise value (GMV) stood at Rs 29,450 crore at the end of Q3FY25.

Last month, MobiKwik's payments division CEO Chandan Joshi resigned from the company citing personal reasons.