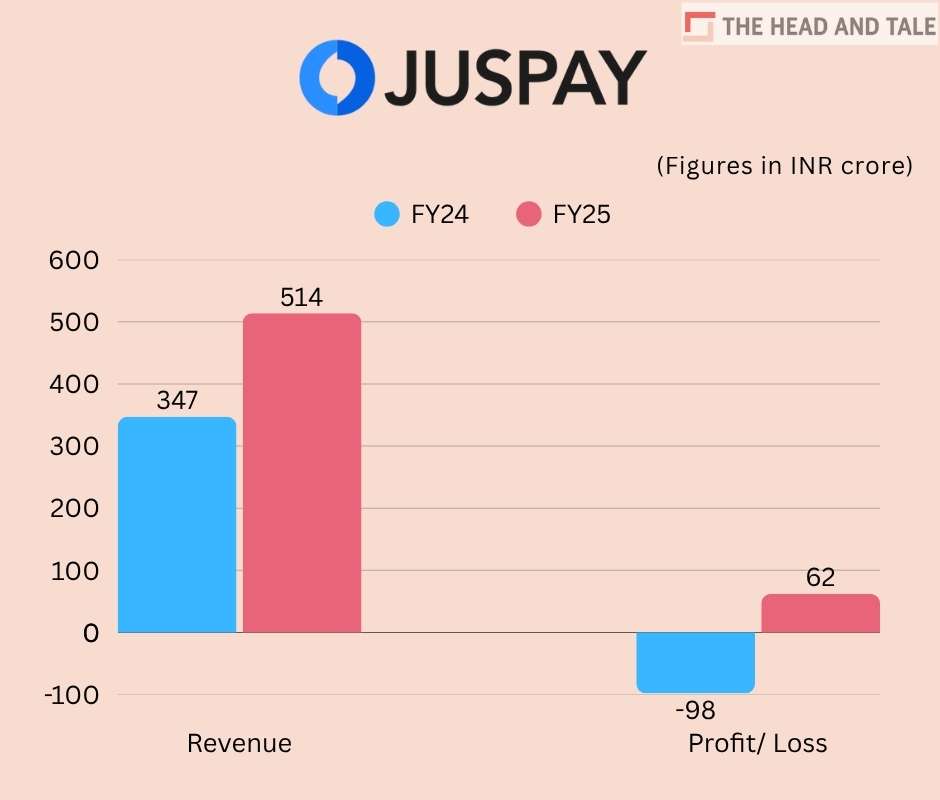

Juspay books Rs 62 crore net profit in FY25; revenue stood at Rs 514 crore

13 Nov 2025, 10:04 AMWith the industry shifting from payment aggregators halting third-party routing to the online gaming ban, it will be worth watching how Juspay’s FY26 numbers evolve.

Arti Singh

Payments orchestration major Juspay has reported Rs 514 crore in FY25 revenues, against Rs 347 crore a year earlier.

The fintech also booked Rs 115 crore in profits, "before exceptional items and tax." However, the net profit stood at Rs 62 crore during the financial year.

The Bengaluru-based company attributed this performance to "sustained growth in digital transaction volumes, an expanding client portfolio, enhanced operational efficiency, and global market expansion."

In FY25, Juspay reported daily transaction volume from 175 million to over 300 million, with annualized total payment volume (TPV) rising from $400 billion to $1 trillion currently.

The growth, according to the company, was driven by the addition of major merchants and banks to its network, including Agoda, Amadeus, HSBC, Tiket, Zurich Insurance. In India, it counts A

The company claims to have expanded its international presence with new offices across the US, Europe, APAC, and LATAM.

"We achieved profitability while expanding our global footprint and strengthening key partnerships. Looking ahead to FY26, we will continue to invest on building secure, interoperable, and next-gen infrastructure that powers seamless experiences for enterprises, banks, and consumers alike," stated

The company said it will continue to invest in next-generation payment innovations, including biometric payments in Brazil’s Pix ecosystem, its open-source orchestration platform Hyperswitch, and a suite of technologies for digital payments.

Founded in 2012 by Vimal Kumar and Ramanathan R.V., who exited in 2019, Juspay works with over 500 enterprises. In April this year, it raised $60 million in a round led by Kedaara Capital, with participation from SoftBank and Accel. The round valued the company at $900 million.

Earlier this year, The Head and Tale exclusively reported that payment aggregator majors such as Razorpay, Cashfree, PhonePe decided to discontinue payment processing via Juspay's orchestrating platform. Juspay's orchestration business accounted for over 50% of its total revenues; and close to 80% of this business came through these payment aggregators. It is not clear if these PAs have ended third-party routing of payments completely or not.

In an exclusive one-hour long interview with us then, Juspay founders talked about the shifting dynamics in payments in India.

However, since then Juspay has focussing on its UPI switch business and international play. Also the online gaming ban is also have an impact on Juspay's overall business. It would be interesting to see how the company's FY26 financial numbers turn out.

The author is Founder and Editor of The Head and Tale. She can be reached at

[email protected]

Tweets @artijourno