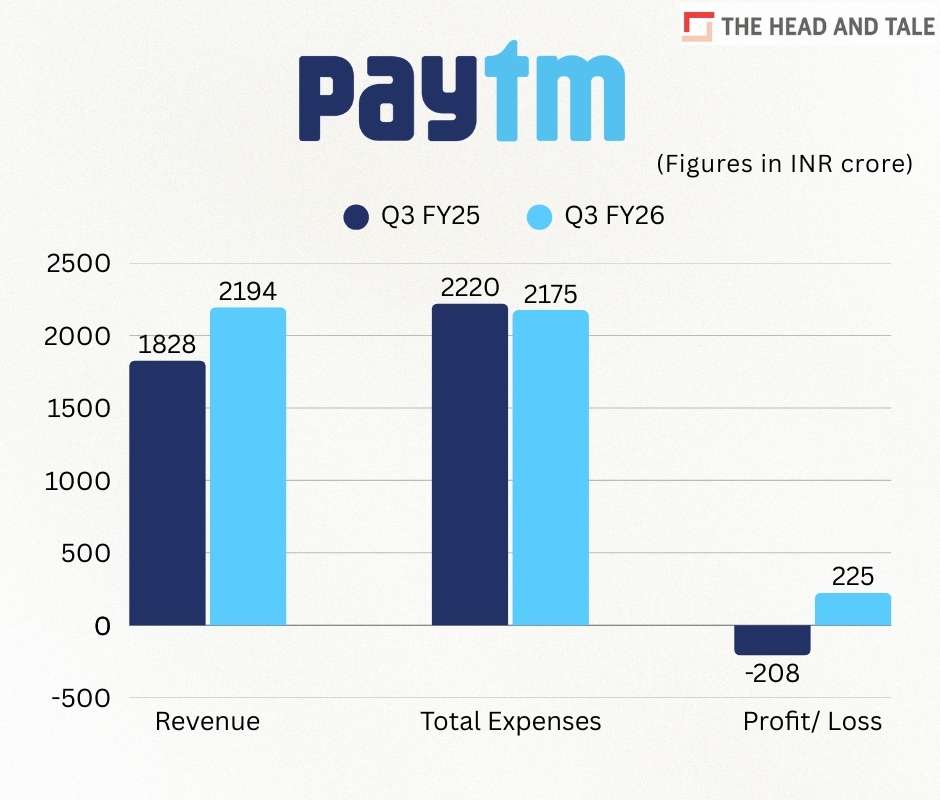

Paytm Q3 revenue up 20% to Rs 2,194 crore, swings to net profit

30 Jan 2026, 11:48 AMTotal expenses of Paytm declined to Rs 2,175 crore during the quarter as compared to Rs 2,220 crore in Q3 FY25.

Team Head&Tale

Paytm reported a 20% jump in revenue from operations to Rs 2,194 crore in the quarter ended December 31, 2025 from Rs 1,828 crore in the corresponding quarter of the previous fiscal.

The fintech major swung to a net profit of Rs 225 crore in Q3 FY26 as compared to a net loss of Rs 208 crore in the corresponding quarter of the previous fiscal, filings with the stock exchanges show.

Total expenses of Paytm declined to Rs 2,175 crore during the quarter as compared to Rs 2,220 crore in Q3 FY25.

Employee cost fell to Rs 721 crore in Q3 FY26 from Rs 756 crore in the corresponding quarter of the previous financial year.

Last quarter was eventful for the Noida-based company as it received authorization from the RBI to operate as a payment aggregator for physical or offline payments and cross border transactions. The company also granted ESOPs worth Rs 16.6 crore and Rs 60 crore under its ESOP Scheme 2019.

In December, Paytm also said that its UAE subsidiary Paytm Arab Payment was selling 49% stake to Abu Dhabi-based Abbar Global Opportunities Holdings. This had come after The Head and Tale had exclusively reported that the Indian fintech major was facing regulatory roadblocks in the UAE.