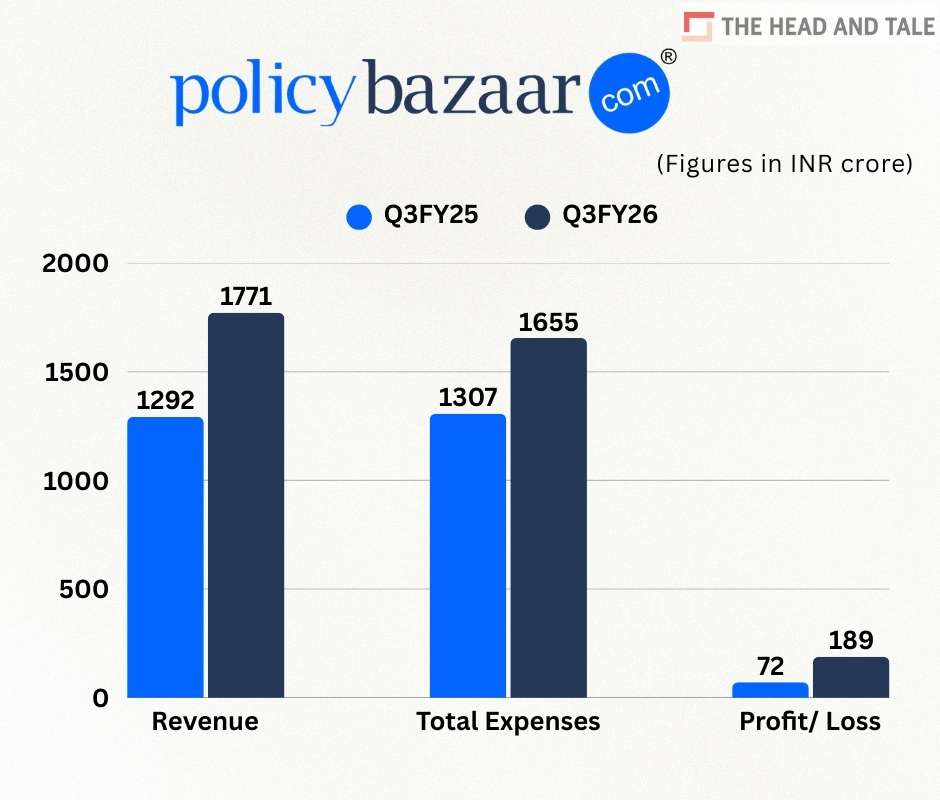

PB Fintech Q3 revenue jumps 37% to Rs 1,771 crore

03 Feb 2026, 10:20 AMThe company's net profit soared 163% to Rs 189 crore in during the quarter ended December.

Team Head&Tale

PB Fintech, the parent company of online insurance marketplace Policybazar, increased revenue from operations to Rs 1,771 crore in Q3 (October-December) of FY26 from Rs 1,292 crore in the same period previous financial year.

The company's net profit soared 163% to Rs 189 crore in during the quarter ended December compared to Rs 71.5 crore in the same quarter last fiscal year.

Total expenses grew 27% to Rs 1,655 crore in Q3 FY26 against Rs 1,307 crore in Q3 FY25. Employee benefit expenses for Q3 FY26 stood at Rs 607 crore.

PB Fintech had in December 2025 approved the fresh allocation of employee stock options to the tune of Rs 644 crore.

Last year, it also received the Reserve Bank of India's authorisation to operate as an online payment aggregator under the name PB Pay Private Ltd.