UPI in Jan: Brokers see 37% jump in transactions to Rs 81,040 crore

11 Feb 2026, 05:27 PMDigital gold purchase via the UPI increased to Rs 3,926.47 crore in January as compared to Rs 2,079.31 crore in December.

Team Head&Tale

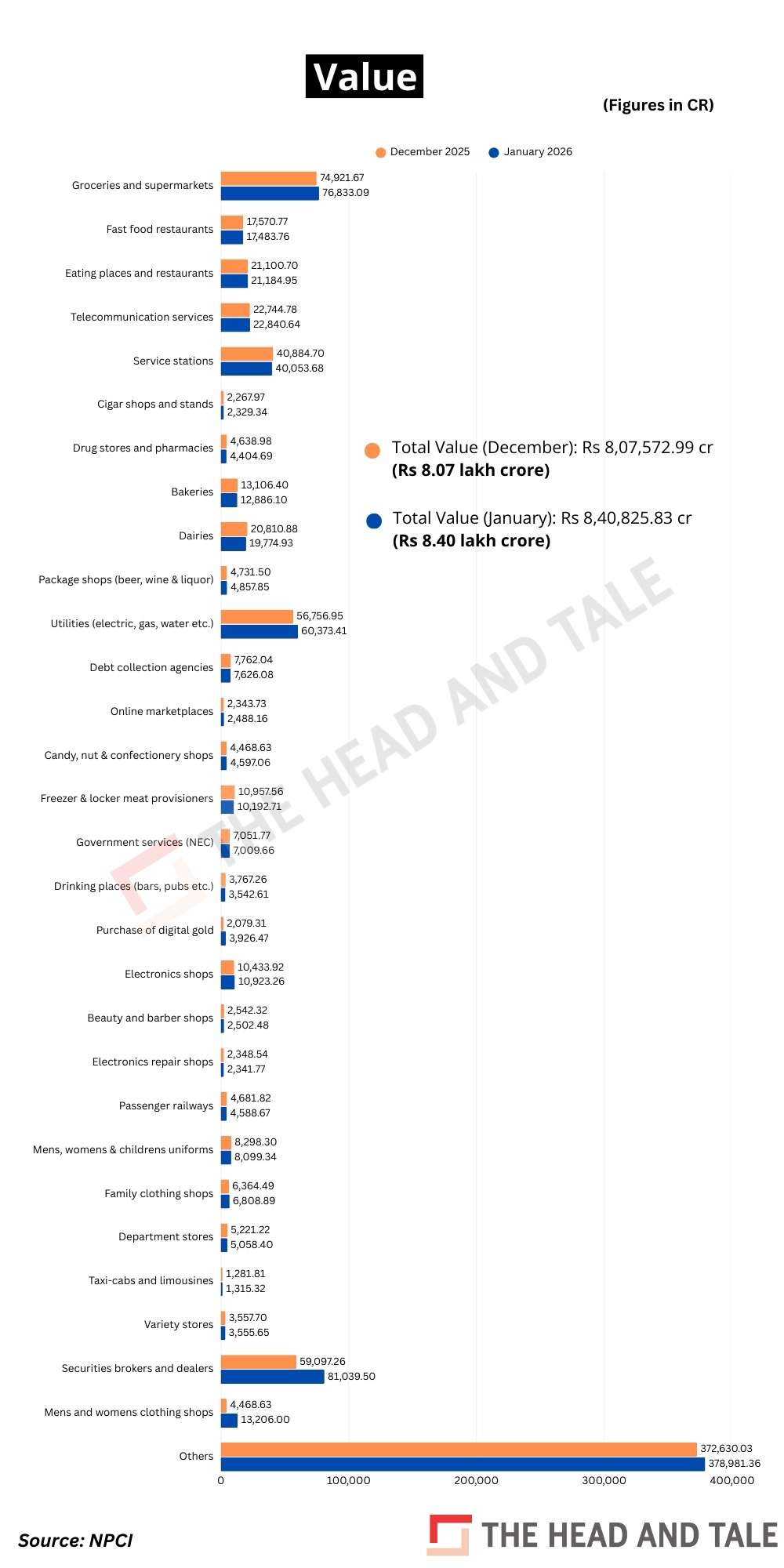

The value of securities brokers and dealer transactions via the unified payments interface (UPI) jumped 37% month-on-month to Rs 81,039.50 crore in January from Rs 59,097.26 crore in December.

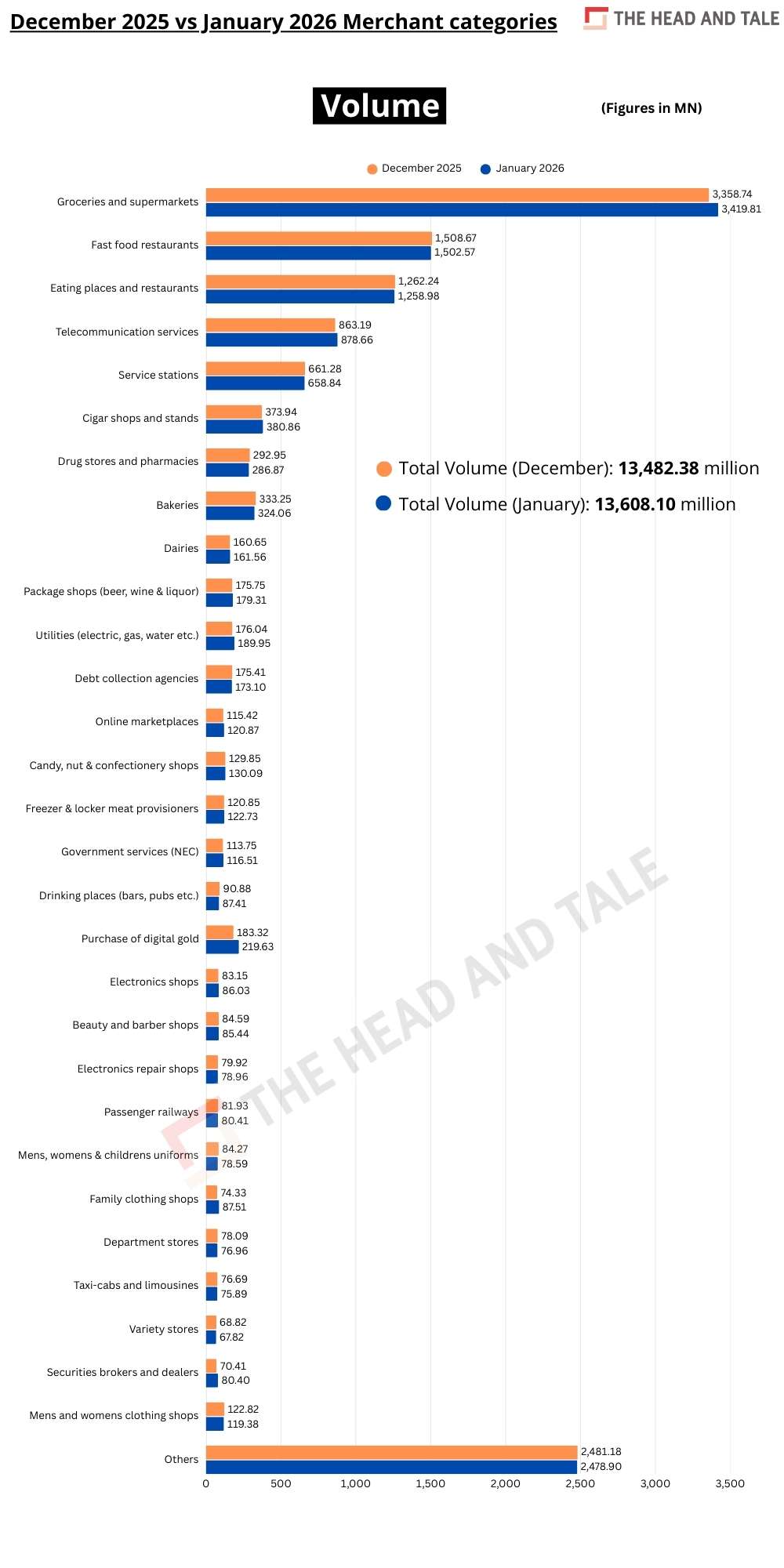

The overall value of the merchant category-wise purchases via UPI rose to Rs 8.41 lakh crore in January across 13,608.10 million transactions as compared to Rs 8.07 lakh crore in December across 13,482.38 million transactions, according to data released by National Payments Corporation of India (NPCI).

Groceries and supermarkets, which accounts for the largest share, recorded 3,419.81 million transactions worth Rs 76,833.09 crore in January versus 3,358.74 million transactions worth Rs 74,921.67 crore in December.

The value of debt collections via the UPI rose to Rs 60,373.41 crore in January from Rs 56,756.95 crore in December.

Digital gold purchase via the UPI increased to Rs 3,926.47 crore in January as compared to Rs 2,079.31 crore in December.

Men's, women's and children's uniforms and commercial clothing saw 78.59 million transactions worth Rs 8,099.34 crore in January versus 84.27 million transactions worth Rs 8,298.30 crore in December; and family clothing shops category witnessed transactions 87.51 million worth Rs 6,808.89 crore in January against 74.33 million worth Rs 6,364.49 crore in December.

Online marketplaces witnessed 116.51 million transactions worth Rs 7,009.66 crore via UPI payments in January as compared to 113.75 million transactions worth Rs 7,051.77 crore in December.

Fast food restaurants recorded 1,502.57 million transactions worth Rs 17,483.76 crore in January versus 1,508.67 million transactions worth Rs 17,570.77 crore in December; and eating places and restaurants saw 1,258.98 million UPI transactions worth Rs 21,184.95 crore in January compared to 1,262.24 million worth Rs 21,100.70 crore in December.

Service stations registered 658.84 million transactions worth Rs 40,053.68 crore in January versus 661.28 million transactions worth Rs 40,884.70 crore in December; utilities recorded 161.56 million transactions worth Rs 19,774.93 crore in January compared to 160.65 million transactions worth Rs 20,810.88 crore in December; and telecommunications logged 878.66 million transactions worth Rs 22,840.64 crore in January versus 863.19 million transactions worth Rs 22,744.78 crore in December.

Electronics shops saw 86.03 million transactions worth Rs 10,923.26 crore in January compared to 83.15 million transactions worth Rs 10,433.92 crore in December. Government services category recorded 122.73 million UPI transactions worth Rs 10,192.71 crore in January versus 120.85 million transactions worth Rs 10,957.56 crore in December.

Drug stores and pharmacies recorded 324.06 million transactions worth Rs 12,886.10 crore in January compared to 333.25 million transactions worth Rs 13,106.40 crore in December.

Overall UPI volumes for the month of January was at 21.7 billion worth Rs 28.33 lakh crore in December as compared to 21.63 billion transactions worth Rs 27.96 lakh crore in the previous month. Peer-to-peer (P2P) payments accounted for 8,095.35 million transactions valued at Rs 19.92 lakh crore against 8,152.29 million transactions valued at Rs 19.89 lakh crore.