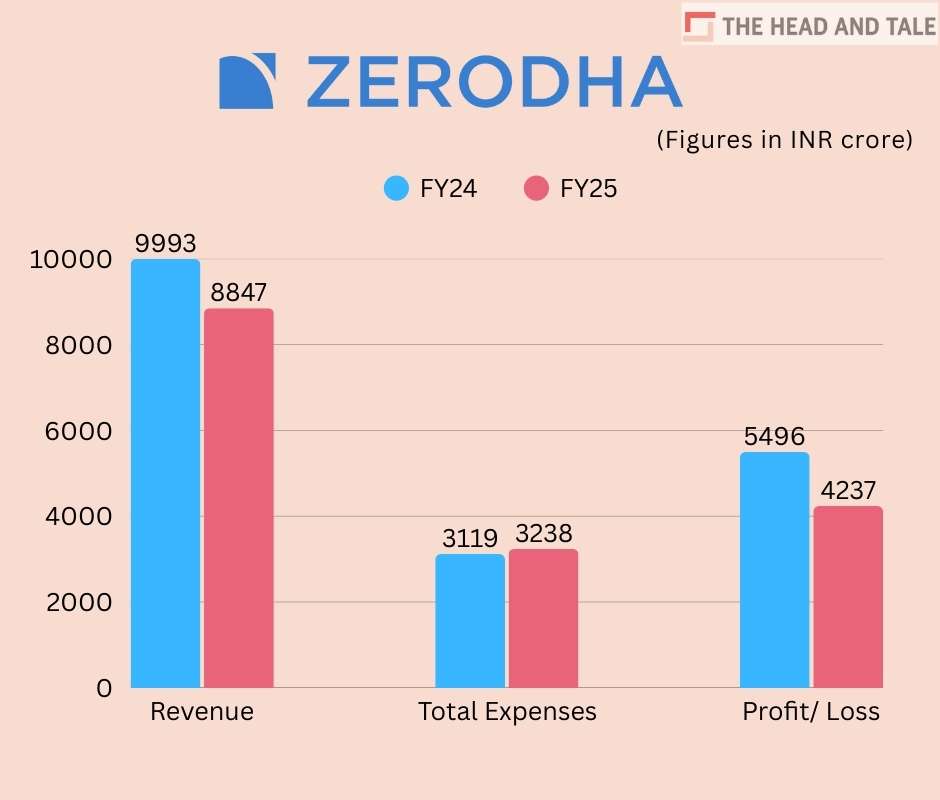

Zerodha FY25 revenue drops 11.5% to Rs 8,847 crore

24 Nov 2025, 01:42 PMZerodha's net profit narrowed to Rs 4,237 crore in FY25 from Rs 5,496 crore in the previous fiscal.

Team Head&Tale

Zerodha recorded an 11.5% drop in revenue from operations to Rs 8,847 crore in the fiscal ended March 31, 2025 from Rs 9,993 crore in the previous fiscal.

Zerodha's net profit narrowed to Rs 4,237 crore in FY25 from Rs 5,496 crore in the previous fiscal, according to consolidated financial statements sourced from the Registrar of Companies.

Total expenses of the stock broking company grew to Rs 3,238 crore during the fiscal as compared to Rs 3,119 crore in FY24.

The bootstrapped company, founded by Nithin Kamath and Nikhil Kamath, had approximately 7.58 million users and a market share of 15.58% as on October 2025. The company saw a drop in users during the month as the space gets competitive and crowded besides being hit by regulatory headwinds.

Still investors are bullish about the segment. Just this month, its rival Groww made a strong stock market debut.

In its first filing since getting listed, Groww last week said that its revenue from operations dropped 9.5% in the second quarter ended September to Rs 1,018.74 from Rs 1,125.38 crore in the same period in FY25. Its net profit, however, jumped 12% to Rs 471 crore during the quarter from Rs 420 crore in the same period in the previous fiscal.