Reserve Bank of India history: Timeline

31 Jul 2025, 05:15 PMFrom managing currency and credit to overseeing modern fintech ecosystems, RBI’s journey mirrors India’s own transformation -- from colonial rule to a liberalised economy.

Muskan Singh

As part of our Money Trivia series, today we take a look at the fascinating history of the Reserve Bank of India (RBI) -- an institution that quietly controls the pulse of the Indian economy.

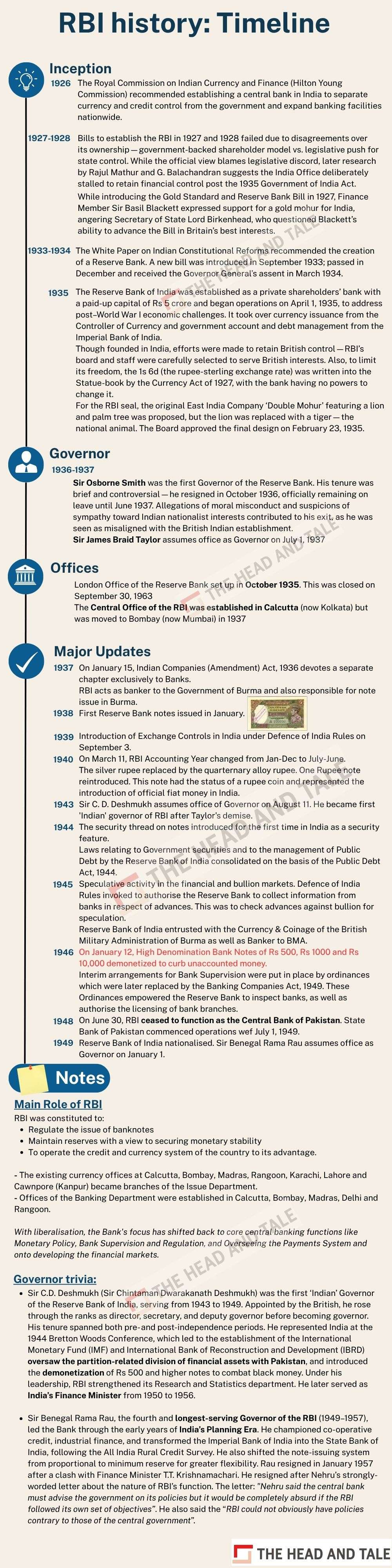

The idea of a central bank for India was first mooted in 1926 by the Hilton Young Commission. But it wasn’t until April 1, 1935 that the RBI actually began operations -- not as a government body, but as a shareholder-owned entity with a paid-up capital of Rs 5 crore. Its original headquarters? Kolkata.

Interestingly, the first Governor, Sir Osborne Smith, lasted barely a year -- replaced by Sir James Taylor in 1937. The RBI’s real Indian face arrived in 1943, when C.D. Deshmukh became the first Indian Governor. He later played a major role in shaping India’s post-independence financial system.

The RBI was also once the central bank for Burma and Pakistan, until they set up their own institutions post-independence.

From managing currency and credit to overseeing modern fintech ecosystems, RBI’s journey mirrors India’s own transformation -- from colonial rule to a liberalised economy.