Three Currencies, One Trend: The Rupee's long decline

16 Dec 2025, 01:43 AMIn this edition, we chart INR-USD, INR–GBP and INR–CNY over the decades - a simple visual look at how the rupee has changed since 1947.

Muskan Singh

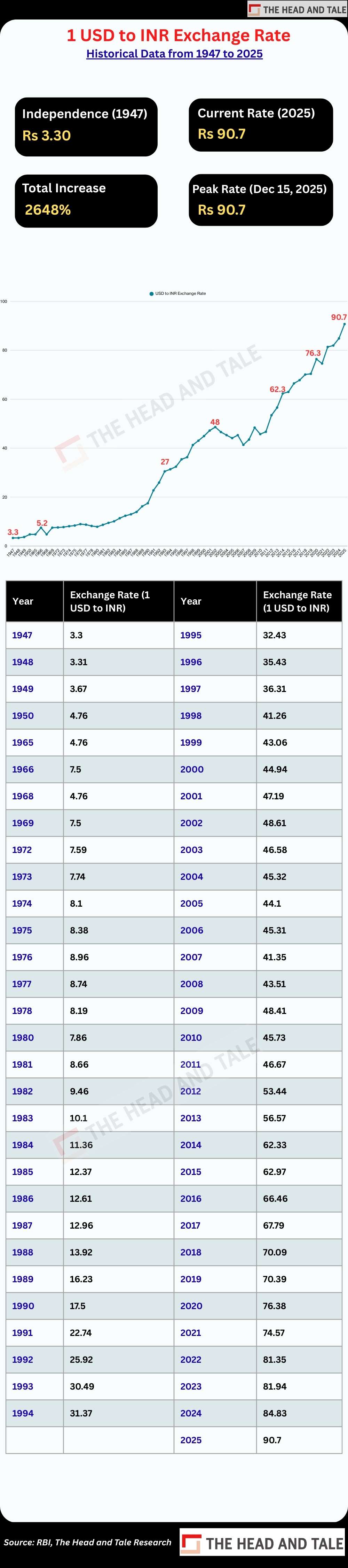

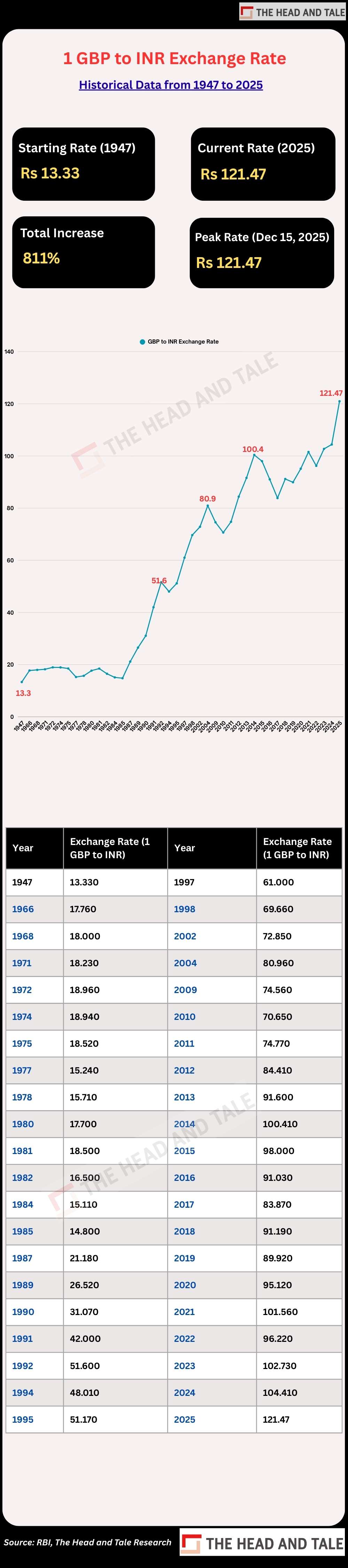

The Indian rupee’s journey since 1947 shows how the world around us has changed. When India became independent, Rs 3.30 equalled 1 USD, and Rs 13.33 equalled 1 GBP. At that time, India tightly controlled its economy, and the rupee was linked to the British Pound. Its stability had more to do with the global system India was part of than with India’s own economic strength.

Things started to change in the mid-1960s. Two wars, weak exports, and rising dependence on foreign aid put pressure on the rupee. This ended in the 1966 devaluation, when the rupee dropped from Rs 4.76 to Rs 7.50 per USD. Even the pound -- India’s old reference point -- went through several devaluations, showing that the fixed-rate world was no longer predictable.

The real shift came in 1991, during India's balance-of-payments crisis. The rupee was slowly moved away from a fixed rate to a market-driven one. Liberalisation meant the currency was no longer held up artificially; supply and demand began to decide its value. Since then, factors like India's trade deficit, foreign capital flows, dependence on oil imports, and inflation have shaped the rupee's steady, long-term decline.

This long slide has taken the rupee from Rs 17.90 per USD in 1991 to a peak of Rs 90.7 in December 2025. Against the pound, it has moved from Rs 13.33 in 1947 to Rs 121.47 today.

The Chinese yuan tells a different story. India began widely tracking its rate in the mid-1990s, just as China's economy was booming. In 1995, 1 CNY was Rs 4.19 -- and now it is Rs 12.8. The yuan has strengthened as China's export engine grew, while the rupee has weakened due to recurring current account pressures.

If you chart INR-USD, INR-GBP, and INR-CNY together, the rupee's biggest weakness appears against economies that either grew very fast (China) or stayed dominant in global finance (US, UK). After 1991, however, the rupee's fall has been smoother and more predictable compared to the sudden shocks of earlier decades.

Many sharp drops in the rupee have lined up with periods of high global oil prices -- a reminder that India’s currency is heavily influenced by its energy bill.

-------------------------------------------------------

-----------------------------------------------------

.jpg)